Read more: Best savings accounts for 2022

Revolut offers a range of service plans for individuals (as well as services for businesses). The free tier of personal service provides access to a basic set of features including a checking account with ATM access and a savings account — with a laggardly 0.05% APY — as well support for some more unusual benefits: access to a Revolut junior account for kids, foreign exchange services and commission-free crypto trading. The Premium tier (.99/month) and Metal tier (.99/month) each add benefits that will chiefly appeal to international travelers: overseas medical insurance, delayed baggage and flight insurance and access to some exclusive airport lounges.

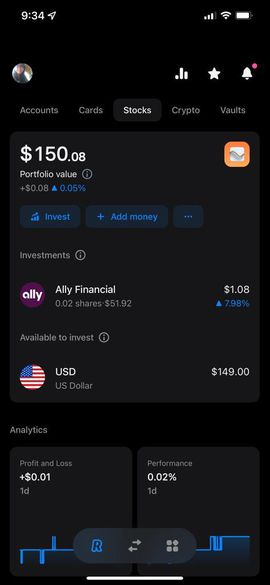

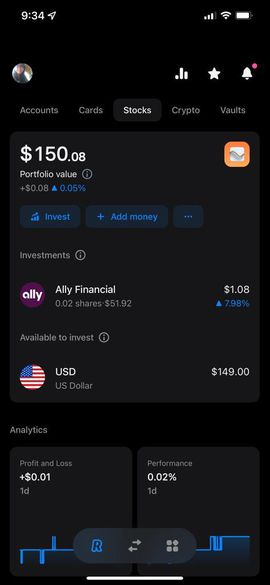

Revolut

Revolut’s stock-trading platform features more or less what you’d expect: access to real-time stock charts, price alerts, graphs, performance data and global market news. Customers can trade full and fractional shares directly on the app, and queue orders after closing times. However, they will not be able to trade on margin — a riskier maneuver, which involves borrowing money to buy and trade securities.

Robinhood, which has come under fire for gamifying investing for a corps of new, inexperienced investors, has generated controversy for offering margin trading. In 2020, a college student killed himself after seeing a negative balance of more than 0,000 in his account, though some of his trades were incomplete. It’s worth noting that many other players in the space, including Webull, Fidelity and Schwab, support margin trading — though some require brokerage customers to apply for access.