Note that some lenders have tightened their requirements since the beginning of the pandemic. If you don’t have a solid credit score, you may not qualify for the best rate.If you can get a lower interest rate or pay off your loan sooner, refinancing can be a great move. But carefully weigh the pros and cons first to make sure it’s a good fit for your situation.

30-year fixed refinance rates

When searching for refinance rates online, it’s important to remember that your specific financial situation will influence the rate you’re offered. Your interest rate will be influenced by market conditions as well as your credit history and application.

15-year fixed-rate refinance

In order for a refinance to make sense, you’ll generally want to get a lower interest rate than your current rate. Aside from interest rates, changing your loan term is another reason to refinance. While interest rates have been low in the past few months, you should look at more than just the market interest rates when deciding whether a refinance is right for you.

10-year fixed-rate refinance

Before applying for a refinance, you should make your application as strong as possible in order to get the best rates available. If you haven’t already, try to improve your credit by monitoring your credit reports, using credit responsibly, and managing your finances carefully. Don’t forget to speak with multiple lenders and shop around to find the best rate.

Where rates are headed

The average 10-year fixed refinance rate right now is 2.51%, a decrease of 7 basis points over last week. A 10-year refinance will typically feature the highest monthly payment of all refinance terms, but the lowest interest rate. A 10-year refinance can help you pay off your house much quicker and save on interest. However, you should analyze your budget and current financial situation to make sure you’ll be able to afford the higher monthly payment.

Major refinance rates decreased today. The average rates for the 10-year, 15-year and 30-year fixed refinances all decreased slightly. While refinance mortgage rates fluctuate, they’re currently at historic lows. If you’re considering refinancing your home, now might be the right time to lock in a good rate. Before applying for a refinance home loan, be sure you review your finances and shop around to find the right refinance mortgage for you.

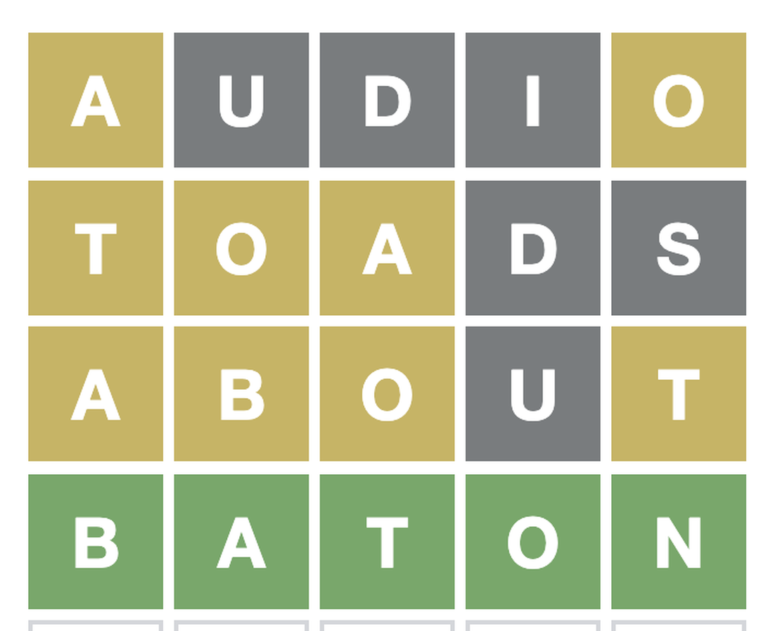

| Product | Rate | Last week | Change |

|---|---|---|---|

| 30-year fixed refi | 3.20% | 3.25% | -0.05 |

| 15-year fixed refi | 2.50% | 2.54% | -0.04 |

| 10-year fixed refi | 2.51% | 2.58% | -0.07 |

The average 15-year fixed refinance rate right now is 2.50%, a decrease of 4 basis points compared to one week ago. Refinancing to a 15-year fixed loan from a 30-year fixed loan will likely raise your monthly payment. But you’ll save more money over time, because you’re paying off your loan quicker. 15-year refinance rates are typically lower than 30-year refinance rates, which will help you save even more in the long run.

How to find the best refinance rate

Average refinance interest ratesSince the beginning of the pandemic, a lot of lenders have been stricter stricter with who they approve for a loan. As such, you may not qualify for a refinance — or a low rate — if you don’t have a solid credit rating.Rates as of June 30, 2021.Generally, you’ll want a high credit score, low credit utilization ratio, and a history of making consistent and on-time payments in order to get the best rates. Researching interest rates online is always a good idea, but you’ll need to connect with a mortgage professional to get your exact refinance rate. You should also take into account any fees and closing costs that might offset the potential savings of a refinance.

Is now a good time to refinance?

For 30-year fixed refinances, the average rate is currently at 3.20%, a decrease of 5 basis points over this time last week. (A basis point is equivalent to 0.01%.) A 30-year fixed refinance will typically have lower monthly payments than a 15-year or 10-year refinance. This makes 30-year refinances good for people who are having difficulties making their monthly payments or simply want a bit more breathing room. However, interest rates for a 30-year refinance will typically be higher than rates for a 15-year or 10-year refinance. It’ll also take you longer to pay off your loan.We track refinance rate trends using data collected by Bankrate, which is owned by CNET’s parent company. Here’s a table with the average refinance rates reported by lenders across the country:A refinance may not always make financial sense. Consider your personal goals and financial circumstances. How long do you plan on staying in your home? Are you refinancing to decrease your monthly payment, pay off your house sooner — or for a combination of reasons? Also keep in mind that closing costs and other fees may require an upfront investment.